Montgomery County, Maryland Información en español

Press Releases - County Council

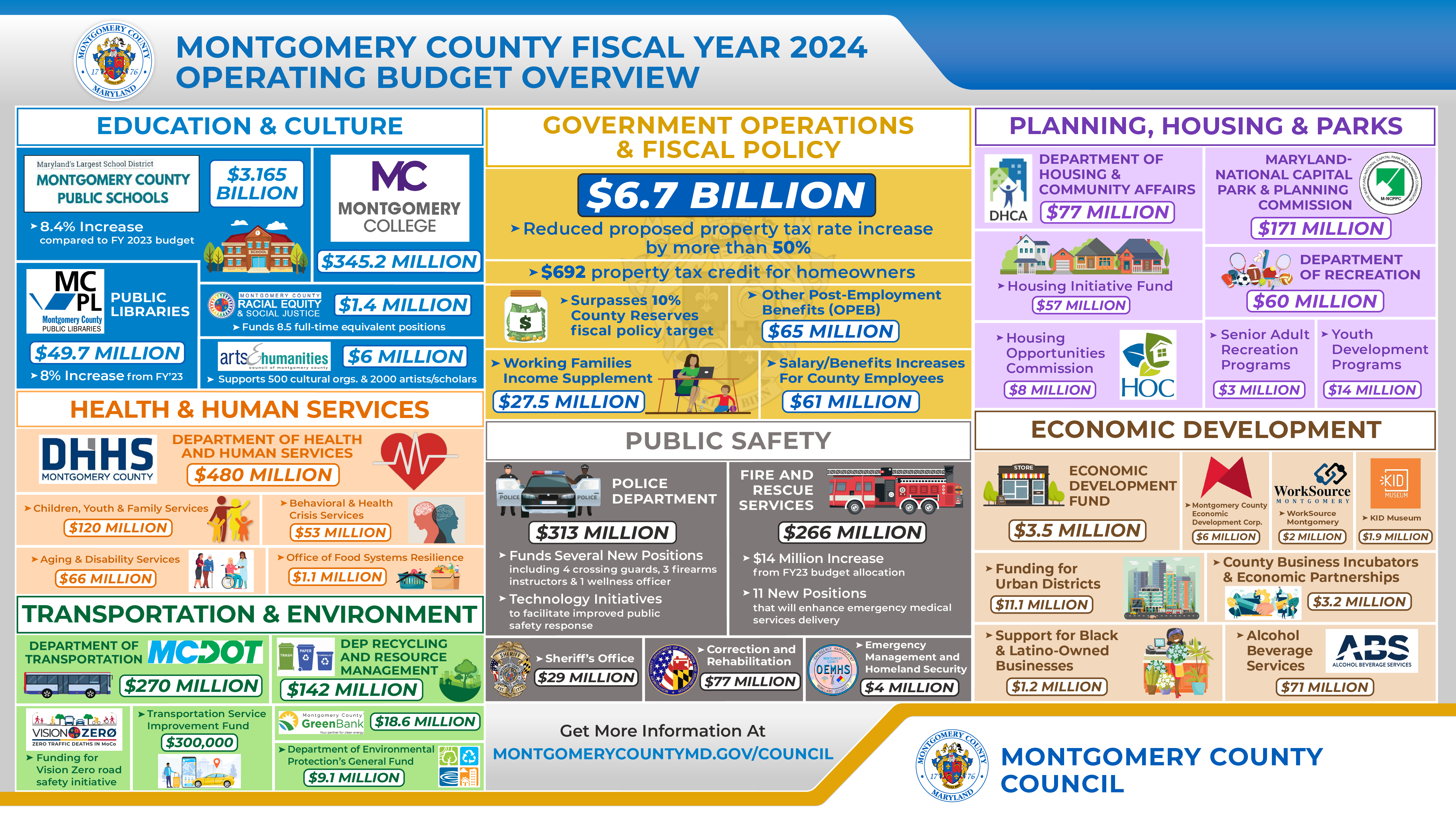

Montgomery County Council Votes to Approve $6.7 Billion Fiscal Year 2024 Operating Budget and Amendments to the FY23-28 Capital Improvements Program Focused on Education, Housing and Economic Development

For Immediate Release: Thursday, May 25, 2023

Council’s budget makes historic investment in education, provides essential services for residents and funds all collective bargaining agreements, while reducing proposed property tax increase by more than half and achieving savings across government operations

County’s effective property tax rate increase will be 4.7 percent, with a $692 property tax credit for homeowners

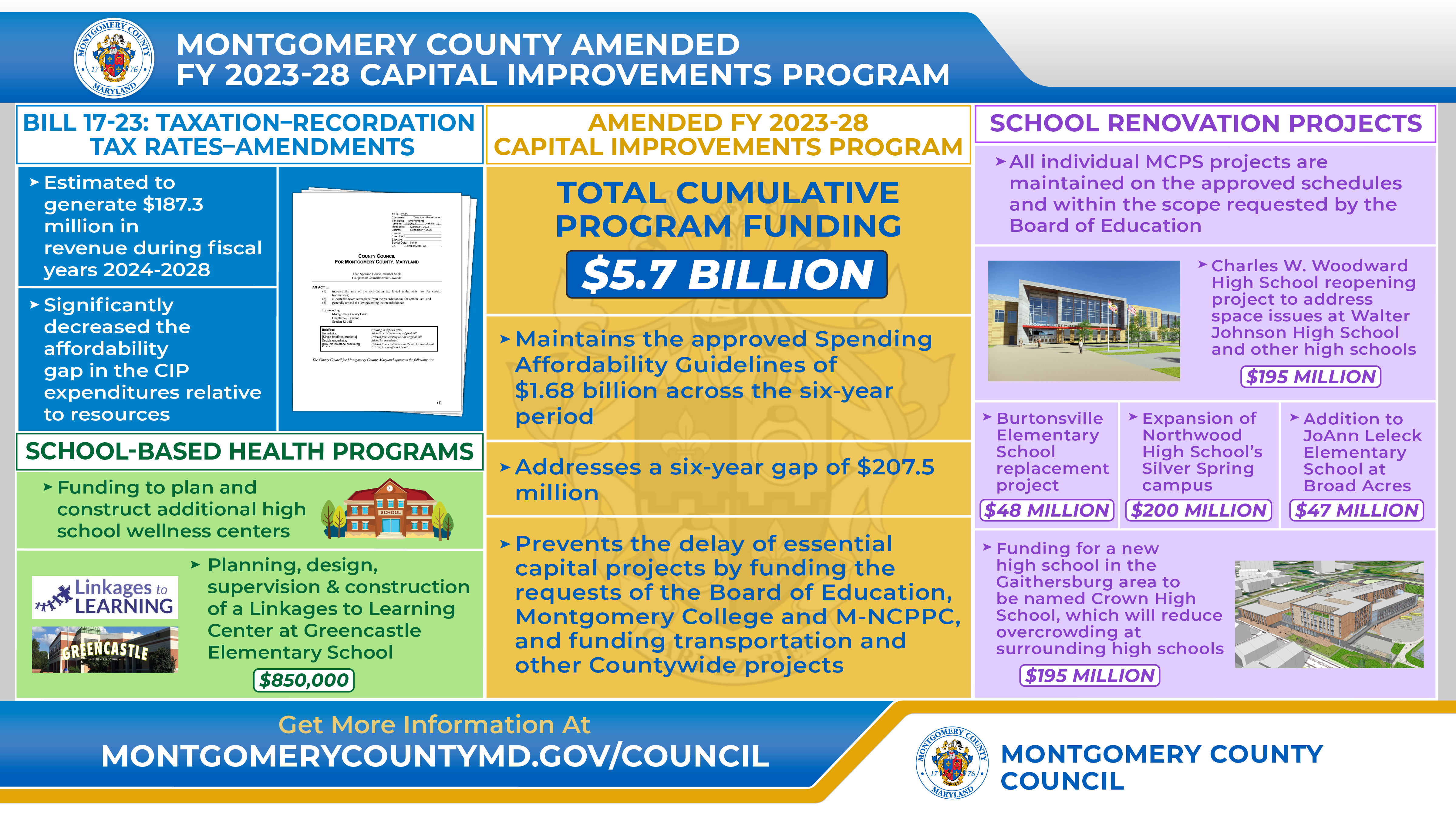

ROCKVILLE, Md., May 25, 2023—Today the Montgomery County Council voted to approve the County’s $6.7 billion Fiscal Year (FY) 2024 Operating Budget and the $5.7 billion amended FY23-28 Capital Improvements Program (CIP).

"This budget makes historic investments in education and in meeting the needs of our residents and our workforce,” said Council President Evan Glass. “We achieved these goals by reducing the proposed property tax, finding efficiencies in government operations and making strategic investments to keep Montgomery County moving forward.”

“The Council’s budget deliberations carefully balanced our strong and steadfast commitment to our students and teachers with our residents’ many other priorities, while also upholding our responsibility to be fiscal stewards of taxpayer dollars," said Glass. "We fully funded teacher contracts and met salary and benefit agreements for our hardworking first responders, police and healthcare workers. At the same time, we cut the County Executive’s proposed 10 percent property tax hike by more than half. I'm grateful to my Council colleagues who brought new and unique perspectives to the table and shared a commitment to transparency and oversight every step of the way."

The Council’s budget deliberations this year focused on balancing the needs of Montgomery County Public Schools (MCPS) with those of other County agencies and departments, as well as reducing the 10-cent property tax rate proposed by County Executive Marc Elrich. Following weeks of deliberations and careful review of Council and committee recommendations, the Council lowered the proposed tax rate and was still able to provide historic funding for MCPS.

The Council voted 7-4 to reduce the proposed property tax rate to a 4.7-cent increase per $100 of assessed value, which reduces the tax burden on property owners by approximately $118 million, while also funding MCPS at the largest year-to-year increase since the Great Recession. The Council also took action to use County resources efficiently by reducing the recommended budget by more than $49 million and identifying an additional $7.7 million in resources. The Council funded a reconciliation list of high priority items to fund essential services for residents totaling $215.4 million. These combined actions reduced the tax supported Fiscal Year 2024 Operating Budget by $110.7 million compared to the Executive’s recommended budget.

With a total budget of $3.165 billion allocated for MCPS, which is approximately half of the County’s tax-supported budget, Montgomery County continues its strong and steadfast commitment to education. The County ranks near the top of all Maryland jurisdictions for total per pupil funding for MCPS. The budget also fully funds Montgomery College at $345 million.

During its committee and Council worksessions, the Council determined cost reductions related to vacancies in County departments that save $7.1 million in taxpayer funds.

In addition, the Council approved Bill 17-23 on May 9, which amends the County’s recordation tax rates in a progressive way for recordations valued at $600,000 or more. The additional resources generated through these updated rates will raise more than $187 million, which will help close the CIP funding gap and will fund essential construction projects for school and transportation infrastructure improvements. The recordation tax premium rates are projected to have no effect on the price of affordable housing and will raise $52 million more for rental assistance over five years.

This budget also increases Montgomery County’s ongoing investments in education through youth programming, expands access to health and human services, generates solutions to develop affordable housing opportunities, increases rental assistance and supports innovative ways to boost economic development in the County.

Moreover, the Council ensured that resources were maintained to honor the County’s long-term commitment to its retired employees and to fully fund the County’s reserves. Funding for these fiscal obligations helps the County retain its triple-A bond rating.

Council President Evan Glass, Vice President Andrew Friedson and Councilmembers Gabe Albornoz, Marilyn Balcombe, Natali Fani-González, Will Jawando, Sidney Katz, Dawn Luedtke, Kristin Mink, Laurie-Anne Sayles and Kate Stewart unanimously voted for the capital budget amendments. Council President Glass, Vice President Friedson and Councilmembers Albornoz, Balcombe, Fani-González, Jawando, Katz, Luedtke, Sayles and Stewart voted to approve the operating budget, including the budget resolutions for County government operations and MCPS. Council President Glass’ full budget comments can be viewed here.

Both the operating and capital budgets begin on July 1.

Montgomery County Public Schools

Almost half of the County’s total budget funds MCPS with a budget of more than $3 billion, which is an increase of 8.4 percent from the FY23 Operating Budget. This funds 97.5 percent of the Board of Education’s request in tax support funding and 68 percent of the requested increase in County funding; 63 percent of the total FY24 MCPS budget is funded by County funds. Bolstered by the 4.7 cent property tax increase dedicated to the schools, an additional $156.4 million in County revenue and $215.7 million in total tax-supported revenue was added for MCPS in FY24. This funding is more than enough to fully fund the negotiated agreements for teachers, support staff and administrators as well as other key priorities.

The 8.5 percent increase in County funding for MCPS in FY24 brings the increased investment in MCPS to a nearly 14 percent increase in County funding alone over the last two budget years.

In addition, the updated recordation tax rates recently approved by the Council largely benefit the MCPS capital budget and allow much needed facility renovations, HVAC replacements and other school infrastructure and capacity projects to move forward, even under historic inflationary and supply chain cost challenges.

The County also provides significant amounts of funding for critical MCPS support services including school health nurses, technology modernization, Linkages to Learning programs and school-based health and wellness centers.

Montgomery College

The Council fully funded Montgomery College’s operating budget at $345.2 million. The College requested the Maintenance of Effort level of $148.4 million, which is the minimum level required by the County, and requested to supplement these funds with $20 million in fund balance for its FY24 operating budget. The College’s budget assumed the first tuition increase since FY20, at a rate per semester hour increase of $2 for County residents, $4 for state residents and $6 for non-residents.

Public Safety

The Council funded a budget of more than $313 million for the Montgomery County Police Department. This is a 5.3 percent increase compared to last year’s budget. The approved budget includes funding for four crossing guard positions, three firearm instructors and a wellness officer plus several technology initiatives to facilitate improved public safety response.

In the Sheriff’s Office, the total budget is $29 million, which is an increase of over $2 million or eight percent from last year’s budget.

The budget for the Department of Correction and Rehabilitation is nearly $77 million. This is an increase of more than $3.5 million, or five percent, over the approved FY23 budget.

The Fire and Rescue Services operating budget is $266 million. This is a $14 million increase from last year. The approved budget includes 11 new positions that will enhance emergency medical services delivery.

The Council included more than $4 million in the budget for the Office of Emergency Management and Homeland Security, including an additional $100,000 for nonprofit security grants for organizations and facilities at high-risk of hate crimes.

Negotiated Agreements

The Council funded salary and benefit increases for employees represented by the Fraternal Order of Police (FOP), the International Association of Fire Fighters (IAFF), the Municipal and County Government Employees' Organization (MCGEO) and non-represented County government employees. In FY24 these increases total more than $61 million.

Economic Development

The Council approved $3.2 million for the County’s incubators and economic partnerships. A new non-departmental account was created this year to support small business. The funding includes more than $1.2 million to support Black and Latino-owned businesses in Montgomery County.

It also approved $3.5 million for the County’s Economic Development Fund, which is used to assist private employers who are located, plan to locate, or substantially expand operations in the County.

It approved nearly $11.1 million in the budget for the Bethesda, Silver Spring and Wheaton Urban Districts. This year, the Council also approved an amendment to the FY24 budget to appropriate funds collected by the newly formed Friendship Heights Urban District.

The Council approved a nearly $1.9 million appropriation for the KID Museum to fund organizational development and growth, expand new initiatives, and deepen community outreach and engagement. The KID Museum provides hands-on learning that develops STEAM education for program participants through creativity and critical thinking skills. It expects to serve more than 40,000 residents in FY24, with approximately half of yearly program participants being from under-resourced communities.

The Council continued its support of the Montgomery County Economic Development Corporation (MCEDC) with an almost $6 million appropriation in FY24. MCEDC advances the County’s economic development goals by connecting businesses located in, locating to, or expanding in the County with critical resources, such as local real estate intelligence, funding, business incentives and talent.

The Council supported WorkSource Montgomery, which is the County’s lead workforce development organization, with an over $2 million appropriation. This is an increase of almost three percent compared to the previous year.

It also approved more than $6 million to the Arts and Humanities Council, which provides the infrastructure to maintain and support 500 cultural organizations and 2,000 artists and scholars in the County.

The Council approved a $71 million operating budget for Alcohol Beverage Services, which provides licensing, wholesale and retail sales of beverage alcohol products, enforcement and education and training programs.

Transportation

The Council funded the Department of Transportation’s (DOT) General, Mass Transit, and Parking Lot District Fund budgets at more than $270 million in total. Nearly $300,000 in funding is included to support the Transportation Service Improvement Fund and funds were also added for bridge inspections and the maintenance of new subdivision roads.

Office of Racial Equity and Social Justice

The Council funded the Office of Racial Equity and Social Justice (ORESJ) at nearly $1.4 million, which is an increase of $122,000 or almost 10 percent from the FY23 approved budget. Personnel costs comprise over three quarters of the budget and fund 8.5 full-time equivalent positions for the ORESJ in FY23.

Office of Food System Resilience

The Council provided $1.1 million in funds to the Office of Food Systems Resilience (OFSR), which develops strategies for improving and maintaining the efficiency, equity, sustainability and resilience of the countywide food systems. FY24 OFSR operating funds will support food security priorities including the Market Money Grants program, gardening grants, Farm to Food Bank program and the Strategic Plan to End Childhood Hunger.

Health and Human Services

The Council funded more than $480 million for the Department of Health and Human Services (DHHS), which is an increase of almost 11 percent compared to last year’s budget. In addition, it included $120 million for Children, Youth and Family Services, $53 million in Behavioral and Health Crisis Services, $98 million for Public Health Services, $59 million for Services to End and Prevent Homelessness and more than $66 million for Aging and Disability Services.

The approved budget includes the following items: $595,069 to operate a new school-based health center at South Lake Elementary School; $110,549 to restore funding to substance abuse rehabilitation providers; $300,000 to restore funding for educational support services through the George B. Thomas Sr. Learning Academy; and $673,699 to continue Youth Harm Reduction Initiative services.

Food insecurity continues to be a significant need in the County; therefore, the budget includes $6.4 million in one-time funding to continue the County’s response to this need.

The Council recognized the extraordinary work of the County’s nonprofit organizations and approved additional funding so that eligible contracts can be increased by three percent. The Council added more than $850,000 to the budget to provide supplemental funding to organizations that serve and care for residents with developmental disabilities and increased funding for the supplement to adult medical day care providers.

The Council also supported funding the County’s Minority Health Initiatives and programs and approved more than $2.5 million in funds to continue their essential and culturally competent work in communities across the County by providing guidance, resources and health care to some of the County’s most vulnerable residents.

It also funded the Guaranteed Income Pilot NDA by more than $3 million, which is a 24 percent increase from the FY23 Approved Budget.

Working Families Income Supplement

The Working Families Income Supplement program was funded at $27.5 million, which provides funds to supplement Maryland’s refundable Earned Income Tax Credit (EITC) and is intended to benefit working families with low incomes in the County. This is a decrease of $25 million due to the end of federal American Rescue Plan Act (ARPA) funding. The Council approved a supplemental appropriation of more than $4 million due to the higher than anticipated number of recipients in the prior year.

Affordable Housing

The Council continued its ongoing commitment to generating and preserving affordable housing. The Council allocated more than $77 million in funds for the Department of Housing and Community Affairs, which aims to preserve and increase the supply of affordable housing, maintain existing housing in a safe and sanitary condition, preserve the safety and quality of residential and commercial areas, ensure fair and equitable relations between landlords and tenants and support the success of common ownership communities.

In addition, the Council supported the production and preservation of affordable housing by allocating $57 million to the Housing Initiative Fund (HIF). The Council also provided $8 million to the Housing Opportunities Commission.

Recreation

The Council funded total expenditures of more than $60 million for the Department of Recreation. This is a nine percent increase compared to last year’s budget. It includes more than $3 million for senior adult programs and more than $14 million for youth development programming. The budget includes the expansion of two youth development programs: TeenWorks, which provides job readiness training and skill building workshops; and Excel Beyond the Bell (EBB) Elementary out of school time programming at two new sites in Harriet R. Tubman and Watkins Mill Elementary Schools.

Environment

The Council approved a $9 million operating budget for the Department of Environmental Protection’s (DEP) General Fund, which is a 20 percent increase from last year's approved budget to expand the County’s Tree Montgomery program and climate-change related efforts.

In addition, the Council approved $18.6 million to fund the Montgomery County Green Bank, which leverages public and private investments to reduce greenhouse gas emissions in the County. The Council approved $33.9 million for the Water Quality Protection Fund, which is an increase of 9.4 percent, while lowering the Executive’s proposed increase in the Water Quality Protection Charge by $2. The Council also approved more than $142 million for DEP’s Recycling and Resource Management Division.

Libraries

The Council funded the total recommended FY24 Operating Budget for the Department of Public Libraries at nearly $50 million, which is an increase of nearly $4 million or eight percent from the FY23 Approved Budget of $45 million. The Council included funding to recruit and hire frontline library positions to provide increased customer service and presence to residents. Additionally, the Council fully funded refurbishment costs for Damascus Library and Senior Center and approved $1 million in state aid for both Damascus and Long Branch library branches for building and site improvements.

Park and Planning

The Council provided $171 million in tax-supported funding for the Maryland-National Capital Park and Planning Commission (M-NCPPC), which is a nearly six percent increase from last year’s approved budget. An additional $300,000 was provided for park activation, natural resources management and internships. Funding was also included for the Germantown Employment Corridor Check-In and the Randolph Road Corridor Study.

Washington Suburban Sanitary Commission

The Montgomery and Prince George’s County Councils held their bi-county meeting and reached a budget agreement for the Washington Suburban Sanitary Commission (WSSC). The Councils fully funded WSSC’s Operating Budget and CIP, and approved a FY24 Operating Budget of $931 million, which is a $66 million or seven percent increase from the FY23 Approved Operating Budget.

Amended FY23-28 Capital Improvements Program

The County's FY23-28 Capital Improvements Program (CIP) as amended is $5.7 billion (without WSSCWater Projects).

In April, the Council received a status update on the Amended FY23-28 CIP affordability. The update identified a total six-year gap of $207.5 million because of the Council’s goals of funding the requests of the Board of Education, Montgomery College and M-NCPPC; not delaying essential capital projects; and staying within the Spending Affordability Guidelines, instead of increasing the guidelines by $40 million as proposed by the Executive.

On May 9, the Council enacted Bill 17-23, Taxation—Recordation Tax Rates—Amendments, which progressively increased the rates for the recordation tax. This increase is estimated to generate $187.3 million in revenue during fiscal years 2024-2028. This action significantly decreased the affordability gap in the CIP expenditures relative to resources.

The CIP approved by the Council maintains the approved Spending Affordability Guidelines for General Obligation Bonds of $1.68 billion across the six-year period. Expenditures are reduced and adjusted each year through a combination of production delays and technical adjustments, as well as a limited number of cuts and deferrals in Montgomery County government and agency projects.

The approved CIP includes the necessary funding to keep all individual MCPS projects on the approved schedules and within the scope requested by the Board of Education. Some of the projects include: maintaining the $48 million Board of Education request to fund the Burtonsville Elementary School replacement project; the $47 million addition to the JoAnn Leleck Elementary School at Broad Acres; the nearly $195 million in funding for a new high school in the Gaithersburg area to be named Crown High School, which will reduce overcrowding at surrounding high schools; more than $200 million to expand Northwood High School in Silver Spring; and more than $195 million for the Charles W. Woodward High School reopening project.

The Council also took action to address school-based health programs by adding funding to plan and construct additional High School Wellness Centers, after a comprehensive analysis of need has been completed for candidate high schools and shifts $1 million in general obligation bond funding to state aid programs. The CIP budget also adds $850,000 in general obligation bonds to fund the planning, design, supervision and construction of a Linkages to Learning Center at Greencastle Elementary School.

Council deliberations on all of these budget items and more can be found on the Council’s website.

# # #

Release ID: 23-197Media Contact: Sonya Healy 240-777-7926, Lucia Jimenez 240-777-7832